Commercial Property

For commercial property, the producer or CSR must be able to understand the parties who may have an insurable interest with the property.

Those parties that have financial stake or equity in a property are referred to as having insurable interest.

There are four types of parties that may have an insurable interest in commercial property:

This party may lose their investment for the property and any income it may generate.

This party may still be collecting loan payments from the owner for the property.

This party may have the right to occupy the property for a set length of time.

This party may have a contractual arrangement with the user (often the lessee) of the property.

In a commercial property insurance policy, standard coverage forms are used to determine what types of property qualify for coverage. The most widely used coverage forms for a commercial property policy are provided by the Insurance Services Office, Inc. (ISO).

These coverage forms have three primary types of coverage

A commercial property policy provides coverage for building property. Even though it is referred to as “building” property, a variety of property is included in this coverage:

Buildings – any six-sided structure

Structures – anything other than a building

Fixtures – any man-made objects attached to land in some manner (not including buildings or structures)

Permanently Installed Machinery and Equipment

Improvements and Betterments – any permanent alterations or repairs to buildings or structures including the addition, alteration, or repair of fixtures or permanently installed machinery or equipment

A commercial property policy provides coverage for the insured’s personal property.

The following types of property are covered while it is within 100 feet of the described location:

Furniture and Fixtures

Machinery

Office Equipment and Supplies

The insured’s interest as a tenant in improvements and betterments

Any leased personal property the insured has a contractual responsibility to insure

Labor, materials, or services the insured provides for the property of others

This coverage applies when there is a suspension of operations to restore or replace lost or damaged property. Under this coverage, the insurance carrier will pay the insured for the loss of business income incurred during the restoration or replacement period.

The coverage applies to two different types of business income:

Net income that would have been earned

Continuing operating expenses (such as payroll)

Additional Coverages & Coverage Extensions

As an attachment to both building and business personal property coverage, almost all commercial property policies will automatically include the following additional coverages:

- Debris Removal

- Preservation of Property

- Fire Department Service Charge

- Pollutant Clean Up and

- Removal Increased Cost of Construction

- Electronic Data (up to $2,500)

As an attachment to both building and business personal property coverage, almost all commercial property policies will automatically include the following coverage extensions:

- Newly Acquired or Constructed Property

- Personal Effects and Property of Others

- Valuable Papers and Records (other than Electronic Data)

- Property Off-Premises

- Outdoor Property

- Non-owned Detached Trailers

This is an optional sub-coverage that could be included with business income. Extra expense coverage also applies when there is a suspension of operations to restore or replace lost or damaged property. Under this coverage, the insurance carrier will pay the insured for the increased expenses incurred during the restoration or replacement period.

The coverage applies to three different extra expenses incurred:

Extra expenses to avoid the suspension of operations

Extra expenses to minimize the suspension of operations

Extra expenses to repair or replace property to reduce the business income loss

This is another optional sub-coverage that could be included with business income. Rental value coverage also applies when there is a suspension of operations to restore or replace lost or damaged building property. If the property is rented out to others, the insurance carrier will pay the insured for the loss of rental income incurred during the restoration or replacement period.

If the insured is the one renting the building property, the insurance carrier will cover the fair rental value for their portion of the occupied property.

A policy limit is the highest amount of damages the insurance carrier will pay for a loss that the insured’s insurance policy covers.

There are three steps an insured and the CSR must take when setting the coverage limits for a commercial property policy,

In commercial property, insurance carriers need to know the value of the property that will be covered by the policy. This is because there are different ways one can calculate property value and these different ways are referred to as “valuation methods.”

There are two primary valuation methods in commercial property:

Actual Cash Value (ACV) – the cost to replace the property minus depreciation

Replacement Cost – the cost to replace the property with like kind and quality without taking depreciation into account

Calculate the Property’s Replacement Cost

Since there are three main coverages in the policy, there are three main replacement costs that need to be calculated:

Building Replacement Cost

Business Personal Property Replacement Cost

Business Income

Now that we know how coverage limits are calculated, the next step is to determine the method for which they will be written into the policy.

Two primary methods are used for writing commercial property coverage limits:

Schedule Coverage – This method involves writing coverage limits that are scheduled (specific) to each type of property coverage. At the time of a loss, this method makes the limit for building coverage separate from the limit for business personal property coverage, as well as, separate from the limit for business income coverage.

Blanket Coverage – This method involves writing coverage limits that blanket (applies to) different types of property coverage.

The limits can be written in such a way that they apply to:

More than one type of property coverage at the same location

The same type of property coverage at multiple locations

All types of property coverages at multiple locations

Let’s say there was a business income loss where the coverage limit was not adequate to cover the loss. If the policy’s coverage limits were written as blanket coverage and in a certain way, the limit for building coverage AND the limit for business personal property coverage could be used to help cover the loss.

One of the most confusing concepts involved in a commercial property policy is the coinsurance provision. Essentially, it is an agreement that requires an insured to purchase adequate insurance coverage limits for their property. Ideally, the coverage limits should reflect the total replacement cost of the property.

The closer the insured’s coverage limits are to 100% of the property’s replacement cost, the cost of insurance decreases via premium credits (rate reductions).

Below are the most common coinsurance percentages,

80% of the property’s total replacement cost

90% of the property’s total replacement cost (5% premium credit)

100% of the property’s total replacement cost (10% premium credit)

Example:

Kelly has property under building coverage that she has determined to have a replacement cost of $100,000. Additionally, she has opted for an 80% coinsurance percentage for her building property. Kelly’s building coverage limit will then be set by the carrier for $80,000.

($100,000 X 0.80) = $80,000

There are two primary valuation methods in commercial property:

Actual Cash Value (ACV) – the cost to replace the property minus depreciation

Replacement Cost – the cost to replace the property with like kind and quality without taking depreciation into account

Calculate the Property’s Replacement Cost

Since there are three main coverages in the policy, there are three main replacement costs that need to be calculated:

Building Replacement Cost

Business Personal Property Replacement Cost

Business Income

The best approach is to first have the insured create a list of the property that falls under building coverage and another list for property that falls under business personal property coverage. Then have the insured determine how much it would cost to replace each item of property. Afterwards, add all the item’s replacement costs together and separate them by coverage.

Example:

Building – $500,000

Business Personal Property – $750,000

This limit is more difficult to calculate as an insured has to make two different predictions:

The amount of income they are expected to generate over the policy period.

The amount of time they will need to repair or replace property after a covered cause of loss.

As we have discussed, insurance carriers need to know which types of property will be covered and their respective coverage limits. In addition, insurance carriers are also concerned with how the property could be damaged and, if it occurs, whether or not a penalty should be placed against the insured if the coverage limits were inadequate.

It is important to help the insured understand these two areas of concern:

Commercial property coverage is not provided for every type of loss a property may experience. Whether or not coverage is applied depends on the type of peril (cause of loss) that caused the property to be damaged or lost.

There are three different covered causes of loss forms that can be written in a commercial property policy.

Even if the cause of loss was covered, the insured’s coverage limits may not be adequate enough to cover a loss and the insured has essentially broken their commitment with the insurance carrier. If so, a penalty is applied and the formula to calculate this penalty is shown below,

(Coverage Limit / Coverage Limit Required) X Loss = Loss Amount Paid

This form involves specifying the perils that will be covered by the commercial property policy. The form provides coverage for the following perils:

Fire

Lightning

Explosion

Smoke

Windstorm

Hail

Riot

Civil Commotion

Aircraft

Vehicles

Vandalism

Sprinkler Leakage

Sinkhole Collapse

Volcanic Action

This form also involves specifying the perils that will be covered by the commercial property policy. In addition to the basic form’s perils, broad form also provides coverage for the following perils:

Falling Objects

Weight of Snow

Ice

Water Damage

Collapse from Specified Causes

Sleet

This form also involves specifying perils; however, instead of listing the covered perils, the perils specified in the policy will be excluded from coverage. The Special Form is also referred to as ‘all risks coverage’ with coverage being provided for all perils unless excluded from the policy.

Common Endorsements

A policy endorsement is an amendment to an insurance policy which adds, modifies, or excludes coverage. Once a policy endorsement is amended to the insurance policy, it becomes part of the legal insurance contract. Unless the policy endorsement specifies a specific term in which the endorsement is valid, it will typically remain part of the policy even through policy renewals.

The most common endorsements are those which offer the additional coverages and coverage extensions.

Common Exclusions

An exclusion is language in an insurance policy that, instead of adding or modifying coverage, removes coverage from the policy. This is sometimes built into the policy language itself, but often times by endorsement. If the excluded coverage is necessary for the insured, the insured can sometimes negotiate for the exclusion to be removed from the policy.

Below are the most common exclusions found in commercial property policies:

Ordinance or Law

Earth Movement

Governmental Action

Nuclear Hazard

Utility Services

War and Military Action

-

Water

-

Fungus, Wet Rot, Dry Rot and Bacteria

-

Artificially Generated Currents

-

Delay or Loss of Market

-

Smoke Damage Caused by Industrial Operations

-

Wear and Tear

-

Collapse

-

Damage Caused by a Steam Engine Explosion

-

Loss Attributable to Continuous Seepage

-

Water Damage Caused by Burst Pipes

-

Losses Caused by Anyone Entrusted with the Property

Reviewing Quotes

It is important to confirm the following when reviewing quotes received from the insurance carriers,

Premium Quoted

Billing Option Selection

Blanket Coverage

Location Information

The Support Cycle

Most often, sending a few emails to the insured is enough to collect the following information:

Schedule of Locations

Building Replacement Cost Amount

Business Personal Property Replacement Cost Amount

Business Income Amount

-

Currently Valued Loss Run Reports – must be requested from the insurance carriers who wrote each of the insured’s policies over the last five policy periods (if applicable).

Send the Submission

A submission is a specific collection of documents provided to an insurance company allowing them to write an insurance policy. It is important that the submission is both accurate and complete. It is what determines the insured’s policy premium or, in some cases, whether or not an insurance company will even consider releasing a quote. Submissions can be sent via fax, email, online, or through services provided by other bridging services.

-

Voluntary Parting under False Pretenses

-

Losses Due to Property Left Out

-

Release of Pollutants

-

Weather Conditions

-

Acts of Persons or Authorities

-

Inadequate Design or Maintenance

A quick overview of the costs for the commercial property policy is typically provided on page one or two of a quote. This lets you quickly determine which quote has the lowest premium.

Billing Option Selection

This insurance carrier has provided the insured with the opportunity to choose their preferred method of paying for the policy. Let the insured know any pros/cons you see with their given situation.

Blanket Coverage

This section will outline the details of any blanket coverage forms in the policy.

The first blanket coverage form is for Business Personal Property (BPP) where the blanket limit across both locations is $500,000.

The second blanket coverage form is for Business Income where the blanket limit across both locations is $1,000,000.

After receiving and reviewing the released quotes from the insurance companies, select the quote with the best pricing and coverage for your proposal.

Present the Proposal

Location Schedule

Statement of Values

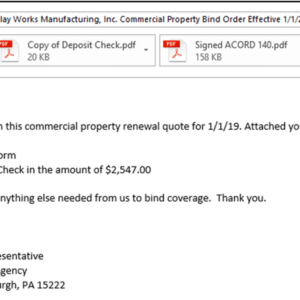

Binding coverage means that an insured has agreed to an insurance company’s quote and is requesting that the coverage begins on the policy’s effective date. This bind coverage request is referred to as a bind order.

Bind orders must include:

A copy of the deposit check

Subjectivities (other forms as required by the insurance carrier)

Here’s a sample of Bind Coverage Request email

Policy Checking

After the insurance carrier binds coverage for the insured, the insurance carrier issues the policy within two to four weeks. In most situations, the customer service representative will be sent the policy before it is sent to the insured. It is critical to check the policy for accuracy and resolve any discrepancies with the insurance carrier prior to sending the policy to the insured.

Policy checking involves reviewing the three documents that should contain identical information:

Support the Insured

Customer service representatives have specific duties in the event of an occurrence.

Notify the insured’s insurance carrier as soon as possible

Collect the who, what, why, when and how regarding the accident from the insured

Immediately send any notices of summons and/or complaints

Cooperate with the insurance carrier