COMMERCIAL AUTO

Commercial Auto Overview

Almost all insurance carriers who write commercial auto (CA) coverage use the Business Auto Policy (BAP) standard created by the Insurance Services Offices, Inc. (ISO). The BAP standard utilizes the Business Auto Coverage Form which details the insured’s commercial auto coverage in five sections. In addition to how the CA coverage is organized, who is an insured also differs from other lines of insurance.

Business Auto Coverage Form

The business auto coverage form helps an insured more easily understand the commercial auto coverage they have by categorizing its details into five sections.

The five sections are as follows:

Covered Autos

Covered Auto Liability Coverage

Physical Damage Coverage

Business Auto Conditions

Definitions

Note: No lesson will be provided for Section 4 as it varies significantly from one policy to another. No lesson will be provided for Section 5 as definitions will be provided throughout this Commercial Auto Course.

Who is an Insured

There are three classifications of insureds who are provided coverage by a commercial auto (CA) policy.

Named Insured

The individual or company listed as the named insured

Permissive Users

Individuals the named insured has provided permission to operate autos covered by the commercial auto policy

Omnibus Insureds

Individuals who are legally liable for the conduct of either the named insured or the permissive users

Covered Autos

The commercial auto policy utilizes covered auto designation symbols to designate the type(s) of autos that will qualify for commercial auto coverage.

If an insured experiences an auto accident, the auto(s) involved may or may not be covered by the commercial auto policy. The autos that will be included for coverage is declared by the covered auto designation symbols specified in the policy. The most common covered auto designation symbols used are symbols 1 through 9.

Below are the symbols and the types of autos they represent:

Any Auto

All Owned Autos

Owned Private Passenger Autos

Owned Commercial Vehicle Autos

Provides no-fault coverage for all owned autos (only used when required by state law)

Provides uninsured motorist coverage for all owned autos (only used when required by state law)

Scheduled Autos (specific autos declared in the policy)

Hired Autos (no coverage if hired from employees, partners or members)

Non-owned Autos (such as autos owned by employees, partners or members used for business operations)

Commercial auto coverage provides an insured with protection from claims for a third-party’s bodily injury (BI) and property damage (PD) and for damage to/loss of an insured’s covered auto.

A commercial auto insurance policy consists of two main coverage sections.

Section 2: Covered Autos Liability Coverage

Section 3: Physical Damage Coverage

Section 2: Covered Autos Liability Coverage

Covered Autos Liability Coverage provides protection from claims for bodily injury and property damage for which an insured is legally responsible. An insured is legally liable if they own, operate, maintain, or use an auto and an accident occurs that results in BI or PD to a third party.

Below are the types of autos that can have covered autos liability coverage:

Autos the insured owns

Autos the insured does not own, but are used for business operations

Autos the insured hires or borrows

Most states have statutes which require an insured to obtain covered autos liability coverage.

Section 3: Physical Damage Coverage

Provides coverage for damages to or the complete loss of an insured’s covered auto. Unlike the previous types of coverage that have been taught, the insured has the ability to choose the extent to which the physical damage coverage protects against a variety of different exposures.

A commercial auto policy can include any combination of the following:

Comprehensive – includes physical damage coverage for any accident other than a collision or overturn

Specified Causes of Loss – includes physical damage coverage for six specific types of causes (referred to as ‘perils’)

Collision – includes physical damage coverage for a collision or overturn

Even though the ultimate choice of coverage is in the hands of the insured, you as a CSR have a duty to initially offer the broadest coverage to them. In this case, offering comprehensive and collision physical damage coverage is a safe and appropriate decision.

Below are the types of autos that can have covered autos liability coverage:

Autos the insured owns

Autos the insured does not own, but are used for business operations

Autos the insured hires or borrows

Most states have statutes which require an insured to obtain covered autos liability coverage.

In addition to the two main types of coverage, there are three types of coverage that can be added to the policy via endorsements.

Medical Pay Available for insureds in most states, medical payments coverage is a ‘no-fault’ coverage that pays for an injured passenger in the insured’s vehicle for reasonable and necessary medical or funeral expenses.

Medical payments coverage will also pay for the following expenses: Surgical, Dental, Chiropractic

Personal injury protection coverage is only found in no-fault states. PIP coverage is a ‘no-fault’ coverage that pays for an injured passenger in the insured’s vehicle for reasonable and necessary medical or funeral expenses; however, PIP provides more extensive coverage than medical payments.

The following are the additional expenses covered by PIP:

Physical/Occupational Therapy and Rehabilitation

Psychiatric Treatment

Other Professional Health Services

Lost Wages

Child Care

Uninsured Motorist (UM) and Underinsured Motorist (UIM) Coverage

Used to add coverage for bodily injury or property damage the insured may incur an accident where the at-fault third-party driver does not have insurance (UM) or has very little insurance coverage (UIM).

Some states have statutes that require an insured to obtain UM and UIM coverage, whereas other states allow one or both coverages to be rejected. Each state handles UM and UIM differently.

Limits of Liability

Eight Types limits found in a commercial auto policy:

Covered Autos Liability BI Per Person Limit

Covered Autos Liability BI Per Accident Limit

Covered Autos Liability PD Limit

Physical Damage Limit

UM/UIM BI Per Person Limit

UM/UIM BI Per Accident Limit

UM/UIM PD Limit

Combined Single Limit (CSL)

1. Covered Autos Liability BI Per Person Limit

This limit is the most the insurance carrier will pay for each third-party person that sustained bodily injury damages in a single accident.

2. Covered Autos Liability BI Per Accident Limit

This limit is the most the insurance carrier will pay for all third-party bodily injury damages in a single accident. Similar to a “per-project aggregate limit”, it acts as a “per-accident aggregate limit” or the cap for the amount an insurance carrier must cover.

3. Covered Autos Liability PD Limit

This limit is the most the insurance carrier will pay for all third-party property damages in a single accident.

4. Physical Damage Limit

This limit is the most the insurance carrier will pay for physical damages to the insured’s covered auto in a single accident.

Unlike other limits, the physical damage limit also specifies that the coverage amount is limited to the cheapest option between the following:

The actual cash value (ACV) of the damaged or stolen property

The cost of repairing or replacing the damaged or stolen property

5. UM/UIM BI Per Person Limit

This limit is the most the insurance carrier will pay for each UM/UIM that sustained bodily injury damages in a single accident.

6. UM/UIM BI Per Accident Limit

This limit is the most the insurance carrier will pay for all UM/UIM bodily injury damages in a single accident. Also similar to a “per-project aggregate limit”, it acts as a “per-accident aggregate limit” or the cap for the amount an insurance carrier must cover.

7. UM/UIM PD Limit

This limit is the most the insurance carrier will pay for all UM/UIM property damages in a single accident.

8. Combined Single Limit (CSL)

This limit is used to provide a more lenient option for payment to be applied an accident. Instead of having to determine individual limits as shown above, it is a combined single limit (CSL) for all damages in an accident. The CSL can be opted for when applying limits in two circumstances:

When setting limits for Covered Autos Liability Coverage – It combines the following limits into one:

Covered Autos Liability BI Per Person Limit

Covered Autos Liability BI Per Accident Limit

Covered Autos Liability PD Limit

When setting limits for UM/UIM Liability Coverage – It combines the following limits into one:

UM/UIM BI Per Person Limit

UM/UIM BI Per Accident Limit

UM/UIM PD Limit

Common Endorsements

A policy endorsement is an amendment to an insurance policy which adds, modifies, or excludes coverage. Once a policy endorsement is amended to the insurance policy, it becomes part of the legal insurance contract. Unless the policy endorsement specifies a specific term which the endorsement is valid, it will typically remain part of the policy even through policy renewals.

Understanding Commercial Auto Endorsements

Commercial auto endorsements each have their own unique identifier called a ‘form number’. The form numbers for commercial auto endorsements are determined by Insurance Services Office, Inc.

Below is an example of a form number and the endorsement it represents:

CA 99 17 07 97

Individual Named Insured

The form number provides three separate pieces of information to the insurance carrier:

CA = Signifies the line of insurance (commercial auto)

99 17 = Specifies the Endorsement (individual named insured)

07 97 = Version Date of the Endorsement (July 1997)

Additional Insured Endorsements

Those individuals or entities not normally covered under the commercial auto policy, but for which the insured desires or is required by contract to provide coverage to those individuals or entities are added via additional insured endorsements.

Examples of additional insured endorsements:

Drive Other Car Coverage – Broadened Coverage For Named Individuals (CA 99 10 07 97)

Individual Named Insured (CA 99 17 07 97)

Employees As Insureds (CA 99 33 02 99)

Employees As Lessor (CA 99 47 03 10)

Designated Insured For Covered Autos Liability Coverage (CA 20 48 02 99)

Lessor – Additional Insured And Loss Payee (CA 20 01 10 13)

Other Policy Endorsements

Primary and Non-Contributory – Other Insurance Condition Endorsement (CA 04 50 11 16)

Often included in policies with an additional insured endorsement, this endorsement stipulates how claims will be handled if the additional insured’s policy and the insured’s policy both offer coverage for a claim. The ‘Primary’ component of the endorsement specifies that the insured’s policy carrier will be the one to cover any losses up to the policy limit, not the additional insured’s policy carrier. The ‘Non-Contributory’ component of the endorsement states that the insured’s policy carrier will not seek a portion of the covered losses from the additional insured’s policy carrier. Only if the insured’s policy limits have been reached would the additional insured’s policy cover the additional losses in a claim.

In essence, even though both party’s policies may provide coverage for a claim, the insurance policy with the ‘Primary and Non-Contributory Endorsement’ will take the loss and make coverage payments up to their policy limits.

Waiver of Transfer of Rights of Recovery Against Others to Us (Waiver of Subrogation) Endorsement (CA 04 44 03 10)

Can be equated to the workers’ compensation waiver of subrogation endorsement where one party agrees to waive its right to pursue the other party in the case of a loss. There are also two versions of this endorsement for commercial auto policies: Scheduled and Blanket.

Uninsured Motorist (UM) and Underinsured Motorist (UIM) Coverage Endorsement (form number varies by state)

Used to add coverage for damages the insured may incur in an accident where the at-fault driver does not have (UM) or has very little (UIM) auto liability insurance coverage. Some states require UM and UIM coverage by law, whereas other states allow one or both coverages to be rejected. Each state handles UM and UIM differently.

Note: Ask your supervisor regarding your state’s law(s) for UM and UIM coverage.

DID YOU KNOW?

There are many more standard endorsements used in commercial auto policies and even more that are specifically created by individual insurance carriers. Each endorsement that you do not recognize should be investigated to understand its true meaning and intent.

Common Exclusions

An exclusion is language in an insurance policy that, instead of adding or modifying coverage, removes coverage from the policy. This is sometimes built into the policy language itself, but often times by endorsement. If the excluded coverage is necessary for the insured, the insured can sometimes negotiate for the exclusion to be removed from the policy.

Expected or Intended Injury

Contractual Liability

Workers’ Compensation

Employee Indemnification and Employer’s Liability

Fellow Employee

Care, Custody or Control

Handling of Property

Movement of Property by Mechanical Device

Operations

Completed Operations

Pollution

War

Racing

Specific causes of loss – nuclear hazards, contamination, war, etc.

Specific activities – organized racing, demolition contests, stunting activities, etc.

Specific perils to specific equipment – loss caused by or resulting from wear and tear, freezing, blowouts, etc.

Specific types of equipment – tapes, records, data electronic devices, etc.

Will not pay for loss to a covered auto due to reduction in value

Obtain Required Submission Schedule

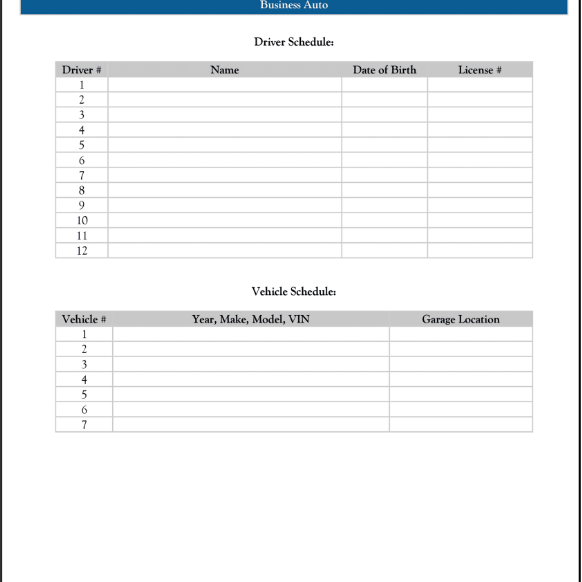

An insurance carrier writing a commercial auto policy does not use any sales, payroll, or cost figures to calculate the premium. The exposures used to calculate premium are the number of drivers, the quality of drivers, and the number of vehicles used for their business operations. As such, it is necessary for an insured to provide you with a driver and vehicle schedule. Once this is collected, you may then run a motor vehicle report (MVR) to collect additional driving record information required by the insurance carrier.

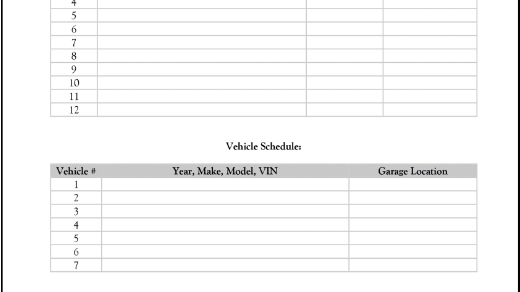

Collecting driver information from the insured can be as easy as sending an email to an insured requesting a list of drivers they’d like to include on the policy. This list is often referred to as the insured’s driver schedule.

Three pieces of information are needed to be included on the list for each driver:

Full Name

Date of Birth (DOB)

Driver’s License Number

Collecting vehicle information from the insured can also be done via email, but the information required differs from a driver schedule. This list of vehicle information is often referred to as the insured’s vehicle schedule.

Five pieces of information are needed to be included on the list for each vehicle:

Year

Make

Model

Vehicle Identification Number (VIN)

Garage Location (where are the vehicles stored when not in use)

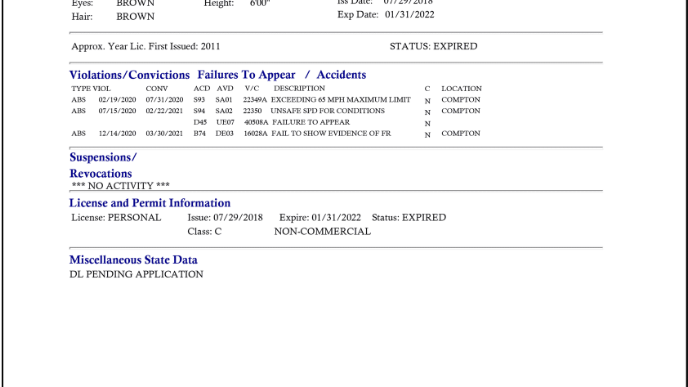

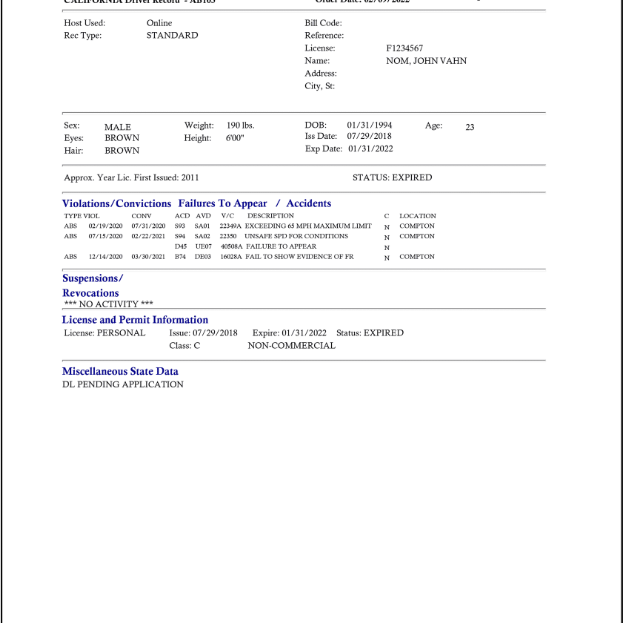

Once the driver schedule has been received, a motor vehicle report can then be run. A motor vehicle report provides the insurance carrier with additional driver information needed to assess the risk of insuring the insured and calculate the policy premium.

The MVR contains the following information for each driver:

Driver’s License Information

Traffic Violations

Personal Information

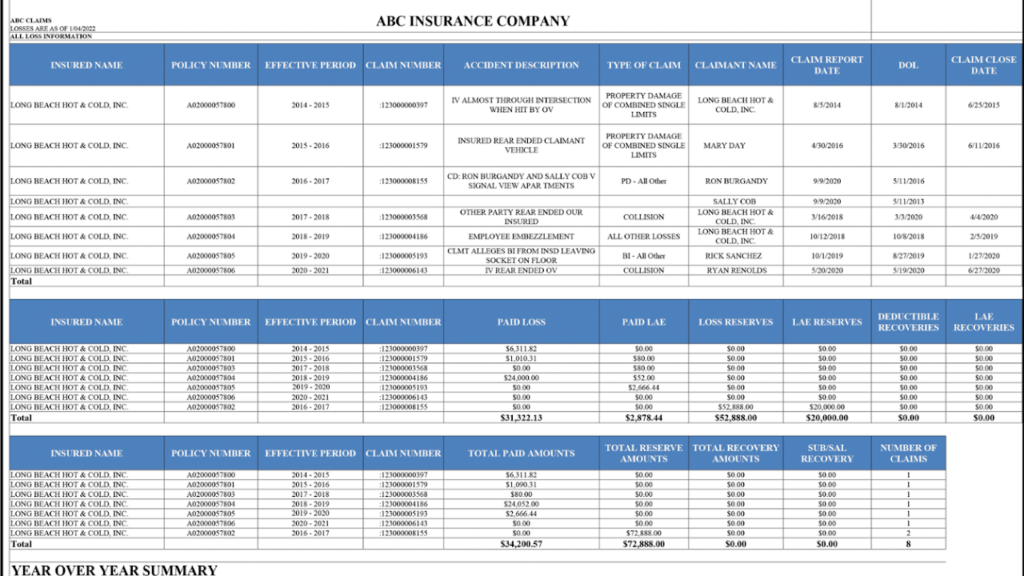

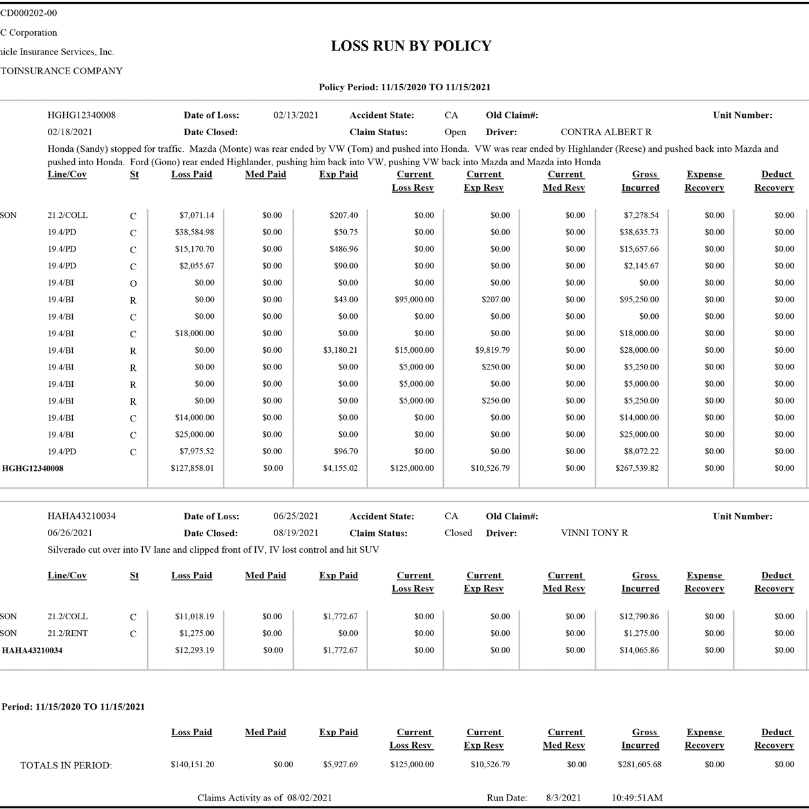

Currently Valued Loss Run Reports

An insured’s policy history is another critical piece of information an insurance carrier needs to accurately calculate a policy premium. A loss run report provides insurance carriers with an insured’s specific policy period history. Insurance companies use loss run reports to better assess the risk of an insured and typically use the last five policy periods in their policy premium calculations.

A currently valued loss run report means the contents were updated within 90 days of when the insured’s proposed policy period would begin. If the loss run report is not currently valued, most insurance companies will not accept the loss run report.

Note: Loss run reports can vary immensely from one insurance company to another.

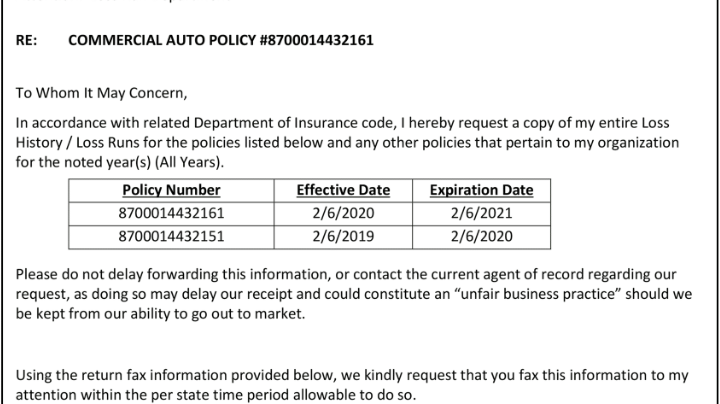

Loss run reports must be requested from the insurance carriers who wrote each of the insured’s policies over the last five policy periods (if applicable).

In order to release the information, the insurance carriers need to receive an agent of service authorization letter from the insured. The letter provides permission for the insurance carrier to release the insured’s loss run data, most often, to the insured’s current agent of record (you).

The insurance policy carrier is bound by law to provide the loss run report within a certain period of time (depending on the state). This is state-regulated to ensure that the insured has the freedom to shop for more affordable insurance policies.

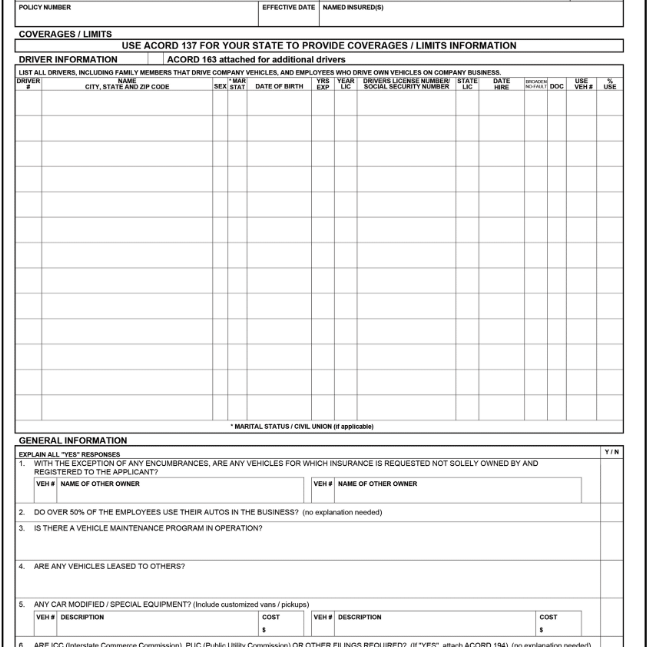

Send the Submission

A submission is a specific collection of documents provided to an insurance company allowing them to write an insurance policy. It is important that the submission is both accurate and complete. It is what determines the insured’s policy premium or, in some cases, whether or not an insurance company will even consider releasing a quote. Submissions can be sent via fax, email, online, or through bridging services.

The submission includes four different documents:

Driver and Vehicle Schedule

Motor Vehicle Records (MVRs)

Currently Valued Loss Run Reports

ACORD 125, 127, 129 and 137 Forms