INLAND MARINE

Overview

Each line of insurance has unique details that must be understood as a customer service representative (CSR). Unlike commercial property, commercial inland marine insurance policies provide coverage specifically for property not confined to a specific location or that is being transported.

There are four types of property eligible for coverage:

Property in Domestic Transit

Any property being moved domestically from one location to another is eligible for coverage by a commercial inland marine policy.

Below are a few examples:

Shipment of property from a supplier to a customer

Private shipments of property from one party to another

Shipment of property from a warehouse to a retail outlet

Sales persons’ samples

Athletic team equipment

Contractors’ job site equipment

Property en route to a fair, exhibition or convention

Fire or police department equipment

Fine arts and antiques in transit

Equipment of any kind that is mostly used off-site

Property in the Custody of a Bailee

A bailee is any person or business who has the property of others in their care, custody, or control for a specific purpose.

The property that is in the care, custody, or control of a bailee is eligible for commercial inland marine coverage.

Examples of bailees’ who are in the custody of eligible property include:

Dry cleaners

Jewelry repairers

Furriers

Computer repair shops

Warehouses

Storage facilities

Delivery services

Exhibit companies

Furniture or appliance repair shops

Property deemed to be an Instrumentality of Transportation and Communication

This eligibility type includes property that is instrumental for communication and/or transportation to occur. Over time, the insurance industry has concluded that these types of property are best covered by commercial inland marine.

Below are property examples:

Docks

Dry docks and marine railways

Transmission lines, towers and related equipment

Outdoor cranes and loading equipment

Bridges

Tunnels

Piers

Pipelines

Wharves

Movable Property

Movable property is any property (other than vehicles) that is moved to multiple locations. Commercial inland marine coverage will follow the property wherever it may go.

Below are property examples:

Contractor’s equipment

Medical equipment

Tools or equipment belonging to trade or repair persons

Equipment which moves from one facility to another

Testing equipment

Musical instruments

Photography equipment

Pet grooming equipment

Vending machines

Inland Marine Coverage

Unlike many other lines of insurance, an insured who needs commercial inland marine coverage could end up with multiple policies from a variety of carriers. In addition, the coverage provided for one insured can vary immensely from the coverage provided to another insured. This is because commercial inland marine coverage is dependent on the insured’s classification of business.

To tackle the variability of coverages that fall under commercial inland marine, the industry has determined there to be two main types of coverages: filed and non-filed.

Filed Coverages

Unlike many other lines of insurance, an insured who needs commercial inland marine coverage could end up with multiple policies from a variety of carriers. In addition, the coverage provided for one insured can vary immensely from the coverage provided to another insured. This is because commercial inland marine coverage is dependent on the insured’s classification of business.

To tackle the variability of coverages that fall under commercial inland marine, the industry has determined there to be two main types of coverages: filed and non-filed.

Theatrical Property Coverage Form

Valuable Papers and Records Coverage Form

Non-Filed Coverages

Non-filed coverages do not have filing requirements. Due to this, the exposure, coverage, and pricing between policies can vary greatly.

Unlike a filed ‘coverage forms’, non-filed coverages are often referred to and written as ‘floaters’.

Example non-filed policies and floaters:

Builder’s Risk Policies

Contractors Equipment Floaters

Installation Floaters

Specialized Computer Policies

Transportation Policies

Transmission Towers

Commercial Inland Marine Coverage

The producer or CSR must fully understand the business operations of the insured to determine the filed and non-filed coverages that are needed. The ability to translate a business operations into different commercial inland marine coverages requires in-depth coverage knowledge that can be gained through our Advanced Commercial Inland Marine course.

Coverage Limits

A policy limit is the highest amount of damages the insurance carrier will pay for a loss that the insured’s insurance policy covers.

There are three steps an insured and the CSR must take when setting the coverage limits for a commercial property policy,

In commercial inland marine, insurance carriers need to know the value of the property that will be covered by the policy. This is because there are different ways one can calculate property value and these different ways are referred to as “valuation methods.”

There are two primary valuation methods in commercial inland marine:

Actual Cash Value (ACV) – the cost to replace the property minus depreciation

Replacement Cost – the cost to replace the property with like kind and quality without taking depreciation into account

The coinsurance provision is an agreement that requires an insured to purchase adequate insurance coverage limits for their property. Ideally, the coverage limits should reflect the property value as determined by the chosen valuation method(s).

Below are the most common coinsurance provisions:

80% of the property’s total value

90% of the property’s total value

100% of the property’s total value

Now that we know how coverage limits are calculated, the next step is to write them into the policy. Unlike commercial property that can have blanket coverage, commercial inland marine coverage limits can only be written through schedule coverage.

Schedule Coverage – This method involves writing coverage limits that are scheduled (specific) to each property item or a group of property items (ex. miscellaneous tools) included in the policy. At the time of a loss, this method makes the limit for one item of property separate from the limit for another.

Covered Causes of Loss

As we have discussed, insurance carriers need to know which types of property will be covered and their respective coverage limits. In addition, insurance carriers are also concerned with how the property could be damaged and, if it occurs, whether or not a penalty should be placed against the insured if the coverage limits were inadequate.

It is important for CSRs to help the insured understand these two areas of concern:

Covered Causes of Loss

Coinsurance Provision – Penalty

Commercial inland marine coverage is not provided for every type of loss a covered property may experience. Whether or not coverage is applied depends on the type of peril (cause of loss) that caused the property to be damaged or lost.

There are three different covered causes of loss forms that can be written in a commercial inland marine policy.

This form involves specifying the perils that will be covered by the commercial inland marine policy. The form provides coverage for the following named perils:

Fire

Lightning

Explosion

Smoke

Windstorm

Hail

Riot

Civil Commotion

Aircraft

Vehicles

Vandalism

Sprinkler Leakage

Sinkhole Collapse

Volcanic Action

This form also involves specifying the perils that will be covered by the commercial inland marine policy. In addition to the basic form’s specified perils, broad form also provides coverage for the following named perils:

Falling Objects

Weight of Snow

Ice

Water Damage

Collapse from Specified Causes

Sleet

This form also involves specifying perils; however, instead of the perils being covered, any specified perils will have coverage excluded from the policy. Special form is also referred to as ‘all risks coverage’ with coverage being provided for any peril not specified on the policy.

Coinsurance Provision - Penalty

Even if the cause of loss was covered, the insured’s coverage limits may not be adequate enough to cover a loss and the insured has essentially broken their commitment with the insurance carrier. If so, a penalty is applied and the formula to calculate this penalty is shown below,

(Coverage Limit / Coverage Limit Required) X Loss = Loss Amount Paid

Coinsurance Penalty Example:

Frank has an 90% coinsurance provision on his policy. Despite this, Frank decided to insure his contractor’s equipment for only $100,000 which was 50% of its $200,000 actual cash value.

During the policy period, Frank’s equipment experienced a partial loss of $50,000, but when the insurance carrier appraised Frank’s equipment, they found that the actual cash value was indeed $200,000. This means the actual coverage limit that was required for Frank’s equipment was supposed to be $180,000 (0.90 X $200,000). Since the insured broke their commitment with the carrier, a penalty is applied.

($100,000 / $180,000) X $50,000 = $27,777

As you can see, the insurance carrier paid far less than the full loss amount because the coinsurance provision penalty was applied.

Common Exclusions

An exclusion is language in an insurance policy that, instead of adding or modifying coverage, removes coverage from the policy. This is sometimes built into the policy language itself, but often times by endorsement. If the excluded coverage is necessary for the insured, the insured can sometimes negotiate for the exclusion to be removed from the policy.

Below are the most common exclusions found in commercial inland marine policies:

Wear and Tear

Nuclear Action

War

Inherent Vice

Government Action

Loss of Income or Market

Dishonest Acts

Inventory Shortage

Request Information

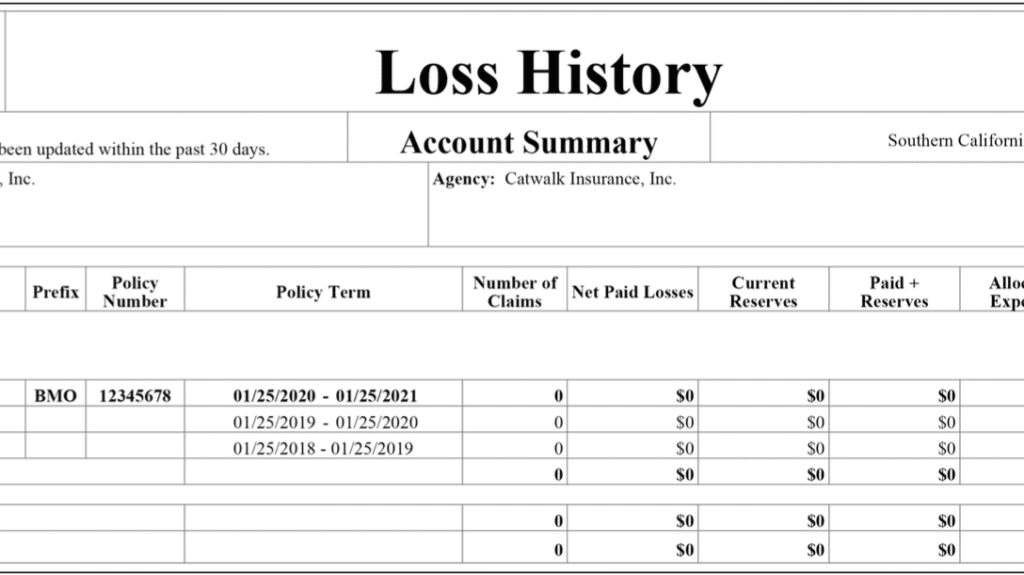

Much like commercial property, supplemental applications are not used in commercial inland marine to obtain the required information for a submission.

Most often, sending a few emails to the insured is enough to collect the following information:

Relevant Building Locations (if any)

Details of the Insured’s Business Operations

Schedule of Property Items

Equipment Storage Locations

Domestic vs. Foreign Transportation Exposure

Send the Submission

A submission is a specific collection of documents provided to an insurance company allowing them to write an insurance policy. It is important that the submission is both accurate and complete. It is what determines the insured’s policy premium or, in some cases, whether or not an insurance company will even consider releasing a quote. Submissions can be sent via fax, email, online, or through services provided by other bridging services.

Commercial inland marine submissions only include two documents:

Reviewing Quotes

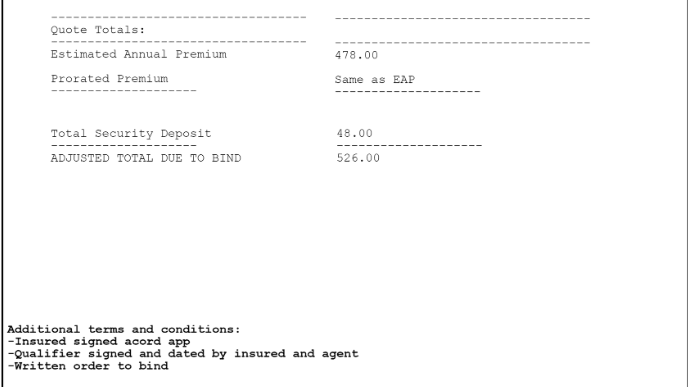

It is important to confirm the following when reviewing quotes received from the insurance carriers,

Coverage Forms (filed and non-filed)

Coverage Limits

Payment Plan

Estimated Annual Premium

Any Deposits or Fees

Any Endorsements and/or Exclusions

Present the Proposal

Most often proposals should be presented to the insured in person by the producer. If this is not possible, proposals can be sent to the insured via email or mail. Proposals not presented in person should still be discussed verbally with the insured.

The videos below provide an example of how a producer might explain the components of a Pollution Insurance proposal to an insured.

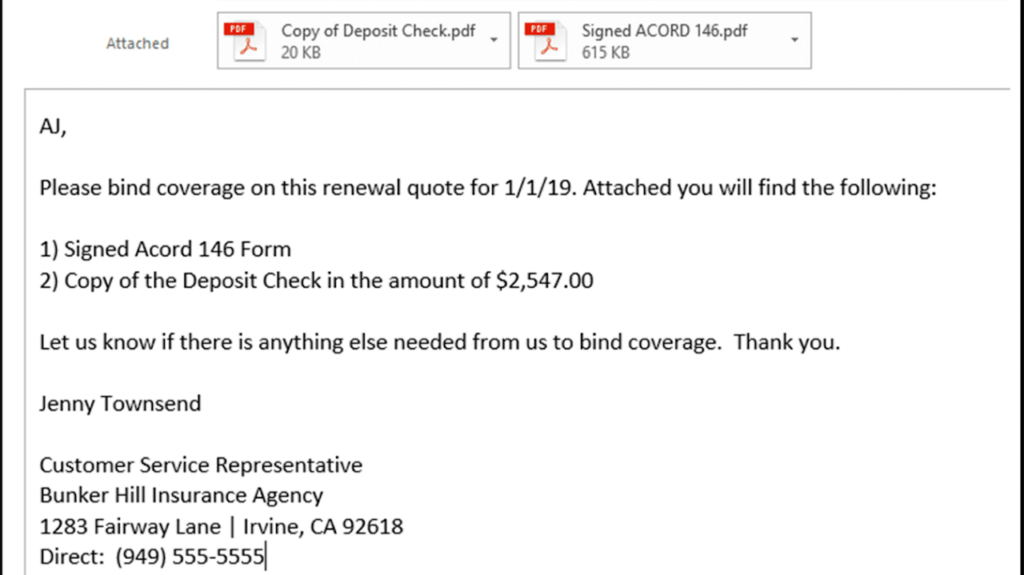

Bind Coverage with the Insurance Company

Binding coverage means that an insured has agreed to an insurance company’s quote and is requesting that the coverage begins on the policy’s effective date. This bind coverage request is referred to as a bind order.

Insurance carriers requires to submit bind orders in writing. Bind orders can be submitted via mail, email, fax or through an insurance carrier’s online system (if available).

Bind Order

Insurance carriers require customer service representatives to submit bind orders in writing. Bind orders can be submitted via mail, email, fax or through an insurance carrier’s online system (if available).

Bind orders must include:

Signed ACORD 146 form

A copy of the deposit check

Subjectivities (other forms as required by the insurance carrier)

Policy Checking

Binding coverage means that an insured has agreed to an insurance company’s quote and is requesting that the coverage begins on the policy’s effective date. This bind coverage request is referred to as a bind order.

Insurance carriers requires to submit bind orders in writing. Bind orders can be submitted via mail, email, fax or through an insurance carrier’s online system (if available).

After the insurance carrier binds coverage for the insured, the insurance carrier issues the policy within two to four weeks. In most situations, the customer service representative will be sent the policy before it is sent to the insured. It is critical to check the policy for accuracy and resolve any discrepancies with the insurance carrier prior to sending the policy to the insured.

Policy checking involves reviewing the three documents that should contain identical information:

The QUOTE, including revisions, provided by the insurance carrier

The PROPOSAL provided to the insured

The POLICY being issued