Introduction to Auto Insurance

Auto insurance helps pay for the injuries and damage that can happen when you own and drive a car or other motor vehicle. Your policy is a legal document, and it is important that you understand it. Your motor vehicle may be an auto, truck, van, motorcycle, or another kind of private passenger vehicle.

You must show financial responsibility for any vehicle that you own, in case of injury to other people or damage to their property. Most people show financial responsibility by buying auto liability insurance. California law states, “All drivers and all owners of a motor vehicle shall at all times be able to establish financial responsibility and shall at all times carry in the vehicle evidence of the form of financial responsibility in effect for the vehicle.”

If you do not have auto liability insurance, you can be fined, your license may be suspended, and your vehicle could be impounded.

Your Auto Policy

Your auto insurance policy is a contract between you and your insurance company. It explains:″

- Your costs.

- Your coverages—the different things your policy covers.

- Your exclusions—the things your policy does not cover.

California Auto Insurance Requirements

What Determines the Cost of Auto Insurance?

Personal Auto Coverages

“Full Coverage” Car Insurance Explaines

Rental Reimbursement Coverage Explaines

Roadside Assistance Program

Understanding your Auto Policy Towing Reimbursement Coverage

Medical Payments Coverage (MedPay) Explained

What is Uninsured/Underinsured Motorist Coverage?

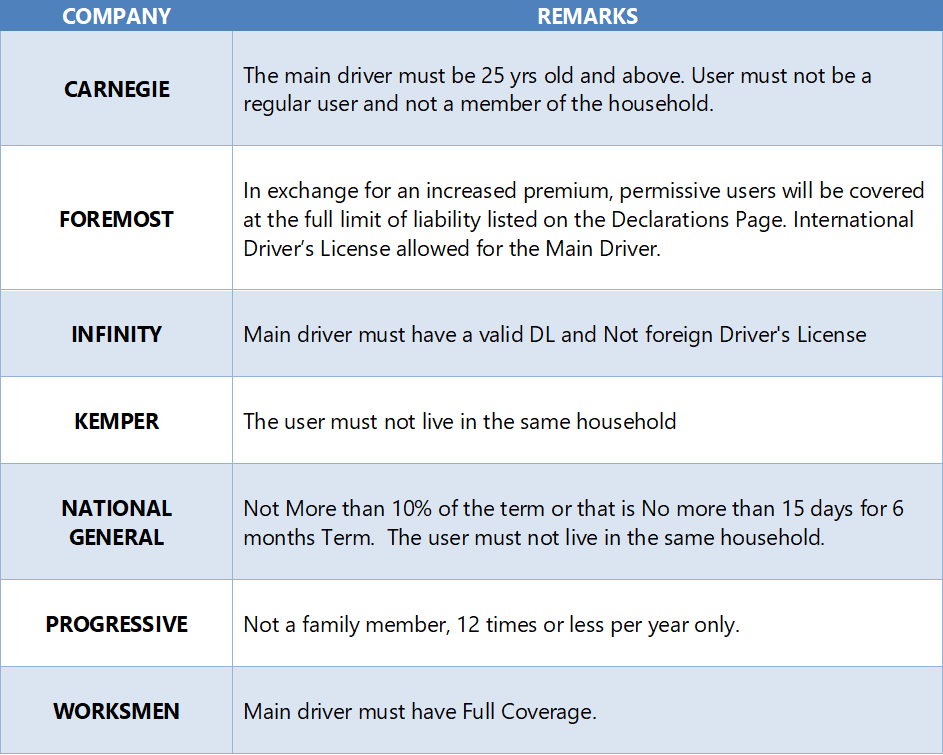

Permissive Use

Permissive use in an automobile insurance policy means that you give a person—who is not specifically covered by name or as a household member—permission to drive your car.

For example, if you allow a friend to borrow your car, that is permissive use. You have given your friend your permission to use your car. Not all automobile insurance policies cover permissive use. Some policies that cover permissive use might provide only limited coverage for permissive users, or require increased deductibles if a permissive use car insurance claim is made.