ACORD FORMS & DOCUMENTS

ACORD forms are used by all insurance professionals. Here’s a refresh on their general format and how to complete this critical piece of the coverage process.

The primary goal of ACORD forms, commonly referred to as ACORDs, is to collect and summarize information about an insured’s operations and insurance needs. While ACORDs are used by all insurance professionals, there are several different types of forms depending on the line of insurance being marketed.

25 – Certificate of Liability Insurance

27 – Evidence of Property Insurance

80 – Homeowner Application

90 – Personal Auto Application

125 – Commercial Insurance Application

126 – Commercial General Liability Section

127 – Business Auto Section

130 – Workers’ Compensation Application

131 – Umbrella / Excess Section

137 – Commercial Auto

140 – Property Section

The agent’s, broker’s, or underwriter’s insurance license determines which ACORDs they are required to use. For example, a Property and Casualty Broker will primarily use ACORDs 125, 126, and 140.

Insurance professionals can choose to complete these in handwritten form or digitally, although the presence of agency management systems like Epic, AMS360, and Jenesis, have made digital completion most common.

ACORD 35

Cancellation Request / Policy Release

Used as tangible evidence of the insured’s instruction to cancel a contract.

ACORD 25

Certificate of Liability Insurance

This certificate is issued as a matter of information only and confers no rights upon the certificate holder. This certificate does not amend, extend or alter the coverage afforded by the policies below.

ACORD 80

Homeowner Application

Used in the process of underwriting for the homeowners

ACORD 90

Certificate of Liability Insurance

This certificate is issued as a matter of information only and confers no rights upon the certificate holder. This certificate does not amend, extend or alter the coverage afforded by the policies below.

ACORD 125

Commercial Insurance Application

ACORD 125 is considered to be the foundation of all commercial applications by providing detailed information regarding the insured. It is most often included with all coverage line submissions since it contains information not duplicated on any other ACORD commercial application form

ACORD 126

This application is used to record client information including things like insured’s exposure, loss history and other necessary business operations details. This form will always be used in combination with the Acord 125 when creating a carrier submission.

ACORD 127

Business Auto Section

Specific to placing commercial insurance, this document details an insured’s drivers, vehicles and other necessary business operations. This form cannot be submitted by itself and must be appended with the ACORD 125.

ACORD 129

Vehicle Schedule

This form can be attached with any other ACORD form. It provides insurance carriers with any additional vehicle information needed by the insured and/or carriers.

ACORD 130

Workers Compensation Application

When required by an insurance carrier, either the producer or the customer service representative will send a supplemental application to an insured for them to complete.

ACORD 131

Has details about liability coverage, affording extended coverage and/or high excess

ACORD 137

California Commercial Auto Coverages and Limits Section

State-specific commercial auto form

ACORD 140

Specific to placing commercial property insurance, this document details an insured’s business locations/buildings, property values and other necessary property details. This form cannot be submitted by itself and must be appended with the ACORD 125.

ACORD 146

Equipment Floater Section

Details an insured’s business locations/buildings, property values, and other necessary property details.

This form cannot be submitted by itself and must be appended with the ACORD 125.

ACORD 146

Property Section

Specific to placing commercial property insurance, this document details an insured’s business locations/buildings, property values and other necessary property details. This form cannot be submitted by itself and must be appended with the ACORD 125.

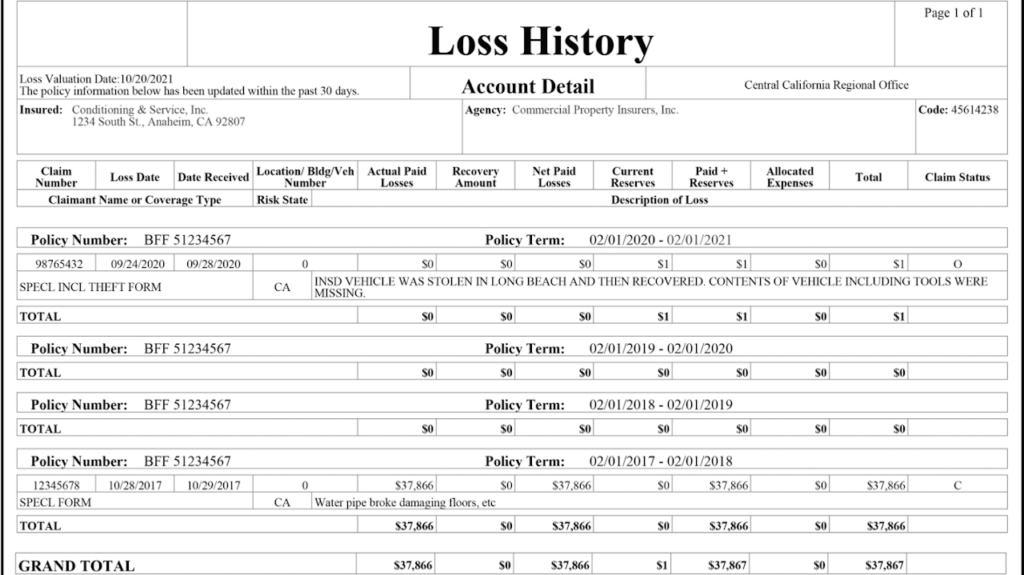

Currently Valued Loss Run Reports

An insured’s policy history is another critical piece of information an insurance carrier needs to accurately calculate a policy premium. A loss run report provides insurance carriers with an insured’s specific policy period history. Insurance companies use loss run reports to better assess the risk of an insured and typically use the last five policy periods in their policy premium calculations.

A currently valued loss run report means the contents were updated within 90 days of when the insured’s proposed policy period would begin. If the loss run report is not currently valued, most insurance companies will not accept the loss run report.

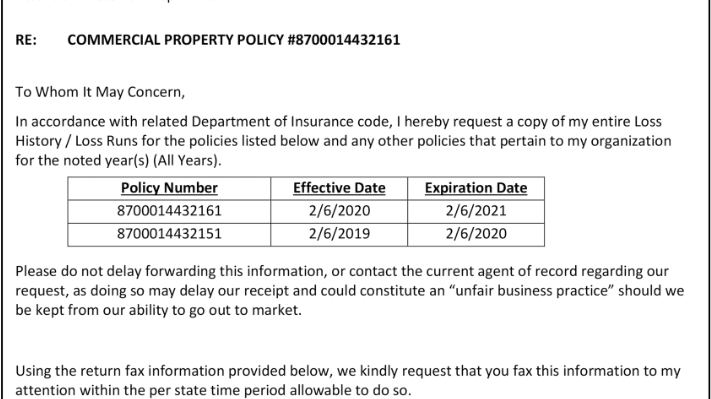

Sample Loss Run Request Letter

In order to release the information, the insurance carriers need to receive an agent of service authorization letter from the insured. The letter provides permission for the insurance carrier to release the insured’s loss run data, most often, to the insured’s current agent of record (you).

The insurance policy carrier is bound by law to provide the loss run report within a certain period of time (dependent on the state). This is state-regulated to ensure that the insured has the freedom to shop for more affordable insurance policies.

Quote Example

Proposal Example

Policy Example