EXCESS & UMBRELLA LIABILITY

Often referred to interchangeably, commercial excess liability and commercial umbrella liability are actually two different lines of insurance. Both share an almost identical function so they are easily misidentified with one another. As this is the case, only one or the other can be placed with the insured. Unlike other lines of insurance, these two policies can only be placed with an insured once they have already secured one or more insurance policies.

Commercial excess liability policies are available once the insured has secured certain underlying policies. When placing an excess liability policy for an insured, the CSR must schedule these underlying policies so the insurance carrier can determine how it will be written.

The three most common underlying policies scheduled in an excess liability policy are:

Employers’ Liability (via Workers’ Compensation)

Commercial General Liability

Commercial Auto

Commercial umbrella liability policies are available once the insured has secured certain primary policies. Unlike excess liability, the primary policies are not scheduled when placing an umbrella liability policy. Instead, the policy broadly references the ‘primary’ policies the commercial umbrella liability policy covers.

The three most common primary policies an umbrella liability policy applies to are:

Employers’ Liability (via Workers’ Compensation)

Commercial General Liability

Commercial Auto

Coverage

The commercial excess liability policy does not add or modify the coverage of the underlying policy or policies. With this being the case, commercial excess liability does not provide any additional coverage for the insured.

The commercial umbrella liability policy is more broadly written than excess liability as it refers to the ‘primary’ policies rather than specifically scheduling any ‘underlying’ policies. With this broader form of writing comes a broader form of coverage. Now if a primary policy excludes coverage that the umbrella policy doesn’t exclude, the insured is protected under the umbrella policy after the self-insured retention (SIR) amount is paid.

Limits

A commercial excess liability policy essentially increases the limits of the scheduled underlying policy or policies. After a claim depletes a limit for an underlying policy, the excess liability policy will cover the remaining amount of a claim up to the specified excess liability’s policy limit.

There are two types of excess liability limits:

Each Occurrence Limit

General Aggregate Limit

A commercial umbrella liability policy essentially increases the limits of the primary policy or policies. After a claim drains a limit for a primary policy, the umbrella liability policy will cover the remaining amount up to the umbrella liability’s policy limit.

There are two types of umbrella liability limits:

Each Occurrence

General Aggregate Limit

An exclusion is language in an insurance policy that, instead of adding or modifying coverage, removes coverage from the policy. This is sometimes built into the policy language itself, but often times by endorsement. If the excluded coverage is necessary for the insured, the insured can sometimes negotiate for the exclusion to be removed from the policy.

Expected or Intended Injury

Aircraft

Watercraft

Property in Care, Custody, or Control

Employment Related Practices

Injury to Fellow Employee

ERISA / Employee Benefits Liabiliy

Punitive Damages

Pollution

Uninsured Motorists and Underinsured Motorists

Asbestos

Commercial excess and umbrella policies offer additional limits or coverage in excess of what is included in the insured’s underlying or primary policies. As such, the CSR needs to first understand which of the insured’s policies will be considered the underlying or primary policies referred to for the excess or umbrella liability policy.

Once this has been determined, the representative must then collect the policy quotes received from the insurance carriers for the insured’s underlying or primary policies:

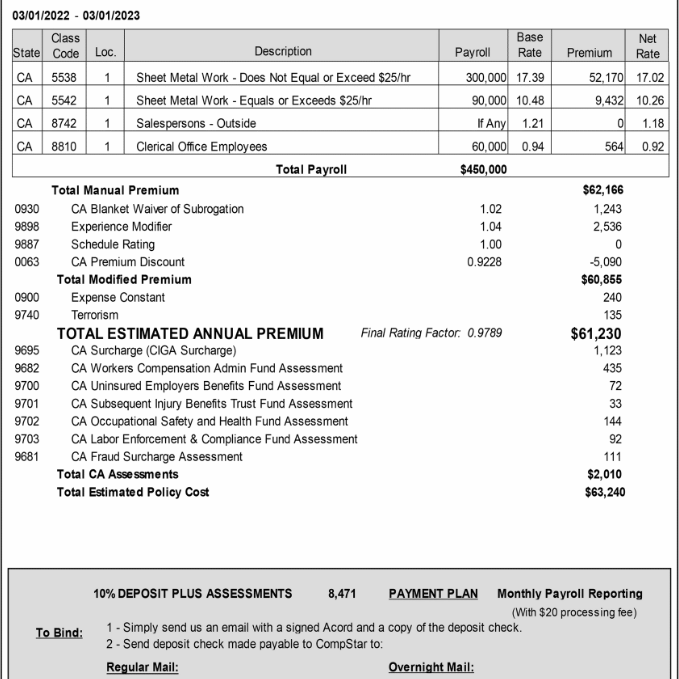

Most often, the policy quotes will be for one or more of the following:

Employers’ Liability (via Workers’ Compensation)

Commercial General Liability

Commercial Auto

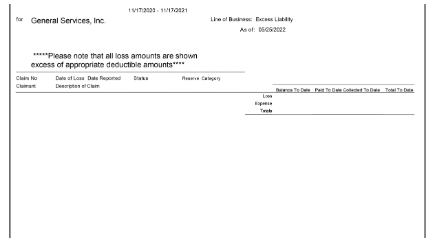

Currently Valued Loss Run Reports

An insured’s policy history is another critical piece of information an insurance carrier needs to accurately calculate a policy premium. A loss run report provides insurance carriers with an insured’s specific policy period history. Insurance companies use loss run reports to better assess the risk of an insured and typically use the last five policy periods in their policy premium calculations.

A currently valued loss run report means the contents were updated within 90 days of when the insured’s proposed policy period would begin. If the loss run report is not currently valued, most insurance companies will not accept the loss run report.

In most cases, commercial excess and umbrella liability loss run reports will show no claims since the underlying or primary policies typically have sufficient limits.

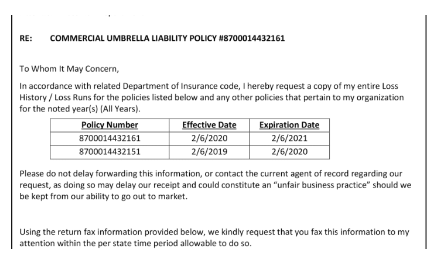

Requesting Loss Run Reports

Loss run reports must be requested from the insurance carriers who wrote each of the insured’s policies over the last five policy periods (if applicable).

In order to release the information, the insurance carriers need to receive an agent of service authorization letter from the insured. The letter provides permission for the insurance carrier to release the insured’s loss run data, most often, to the insured’s current agent of record (you).

The insurance policy carrier is bound by law to provide the loss run report within a certain period of time (dependent on the state). This is state-regulated to ensure that the insured has the freedom to shop for more affordable insurance policies.

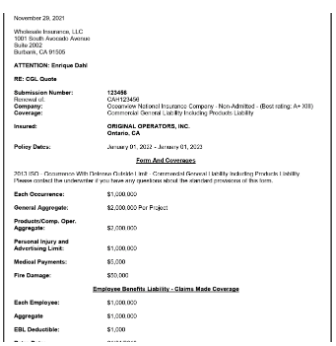

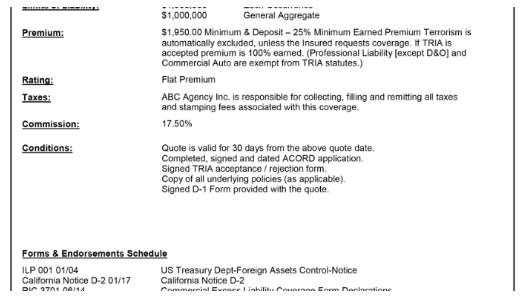

Reviewing Quotes

Quotes provide an accurate summary of pricing and coverage from the insurance company. Most often, quotes are made available to customer service representatives 14 to 30 days prior to the insured’s current policy expiration date. Quotes can be received via email or through an insurance carrier’s online system (if available).

It is important to confirm the following when reviewing quotes received from the insurance carriers,

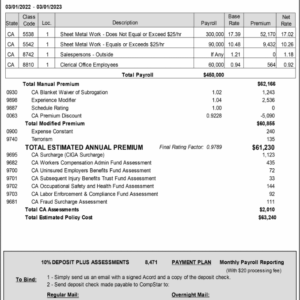

Workers’ Compensation Quote

Commercial General Liability Quote

Commercial Auto Quote

Excess or Umbrella Liability Loss Runs

Completed ACORD Forms

Send the Submission

A submission is a specific collection of documents provided to an insurance company allowing them to write an insurance policy. It is important that the submission is both accurate and complete. It is what determines the insured’s policy premium or, in some cases, whether or not an insurance company will even consider releasing a quote. Submissions can be sent via fax, email, online, or through services provided by other bridging services.

Depending on the number of coverages, the submission typically includes up to five or more different documents:

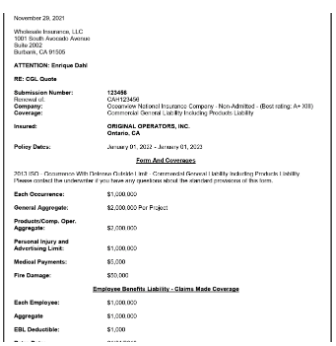

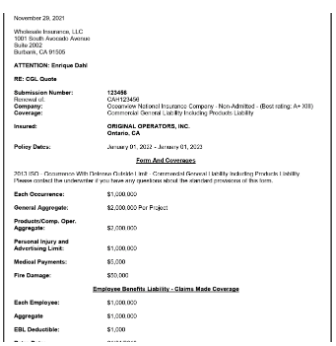

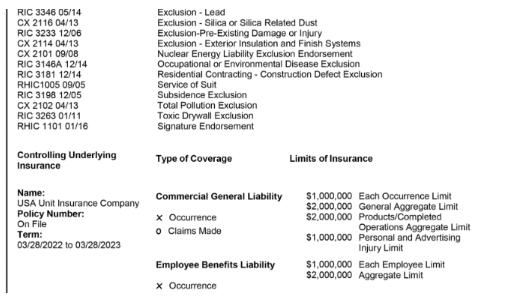

Sample Policy Quote – Page 2

Ensure the limits listed on the quote match the limits that was provided to the insurance carrier on ACORD 131.

For Excess – Ensure the listed coverages and exclusions match those listed on the underlying policies.

For Umbrella – Ensure the listed coverages and exclusions match those listed on the primary policies. Review the exclusions and any additional coverages the quoted policy may provide.

Review the quote to confirm that the correct underlying/primary policies are listed along with the correct coverage forms and limits.

Send the Submission

After receiving and reviewing the released quotes from the insurance companies, select the quote with the best pricing and coverage for your proposal.

Every insurance proposal is structured differently; however, the following should be included in each one,

Details for what is covered and excluded

Pricing breakdown for the needed coverage

Explanation regarding the payment terms

Signed paperwork from the insured

Present the Proposal

Most often proposals should be presented to the insured in person by the producer. If this is not possible, proposals can be sent to the insured via email or mail. Proposals not presented in person should still be discussed verbally with the insured.

The videos below provide an example of how a producer might explain the components of a Pollution Insurance proposal to an insured.

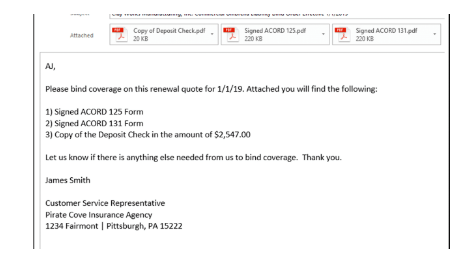

Bind Coverage with the Insurance Company

Binding coverage means that an insured has agreed to an insurance company’s quote and is requesting that the coverage begins on the policy’s effective date. This bind coverage request is referred to as a bind order.

Insurance carriers require customer service representatives to submit bind orders in writing. Bind orders can be submitted via mail, email, fax, or through an insurance carrier’s online system (if available).

Bind orders must include:

Signed ACORD 125 form

Signed ACORD 131 form

A copy of the deposit check

Subjectivities (other forms as required by the insurance carrier)

Policy Checking

After the insurance carrier binds coverage for the insured, the insurance carrier issues a copy of the policy within two to four weeks. In most situations, the customer service representative will be sent the policy before it is sent to the insured. It is critical to check the policy for accuracy and resolve any discrepancies with the insurance carrier prior to sending the policy to the insured.

Policy checking involves reviewing the three documents that should contain identical information:

The QUOTE, including revisions, provided by the insurance carrier

The PROPOSAL provided to the insured

The POLICY being issued